- Palatin’s obesity drug combination just showed remarkable results, achieving nearly triple the weight loss of placebo and effectively stopping weight regain after treatment

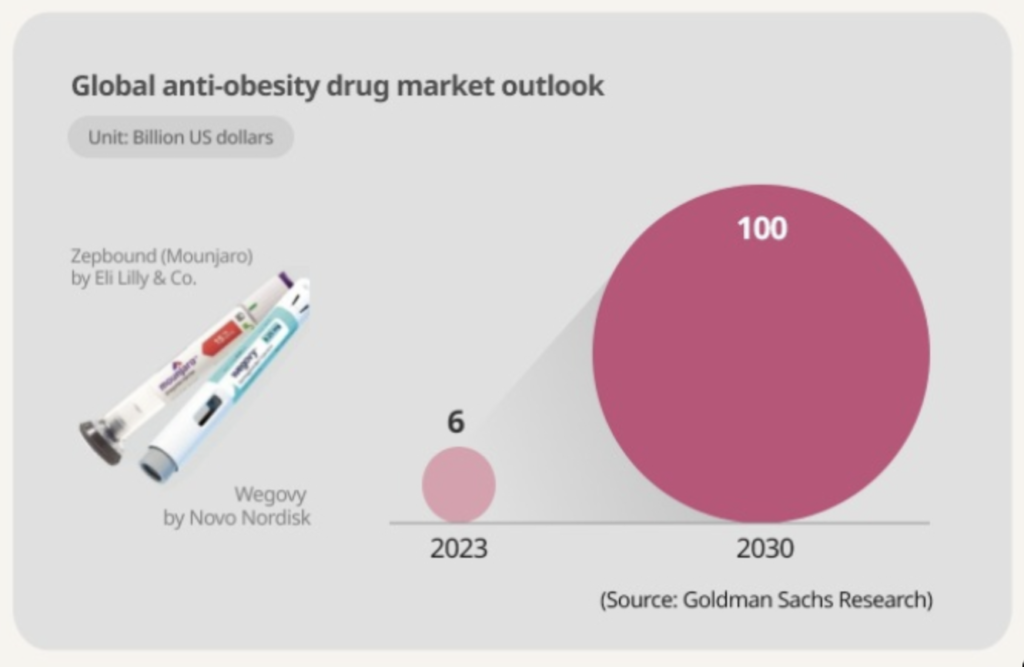

- Positioned in a massive obesity treatment market expected to reach $100 billion by 2030, According to Goldman Sachs Research

- Wall Street analysts see enormous upside potential with a price target of $7.00 for PTN—representing over 700% potential gain from current levels

- Recent wins across multiple programs: positive ulcerative colitis results, FDA orphan drug designation, and successful diabetic nephropathy treatment

Palatin Technologies (NYSE American: PTN) has quietly been building a remarkable pipeline of treatments that address some of the most significant healthcare challenges of our time, with their recent obesity drug breakthrough potentially positioning them for substantial growth in a rapidly expanding market.

Recent Breakthrough in Obesity Treatment

Palatin just announced compelling topline results from its Phase 2 obesity study, demonstrating that its melanocortin-4 receptor (MC4R) agonist bremelanotide, when combined with the popular GLP-1 drug tirzepatide, achieved a 4.4% weight reduction compared to just 1.6% for placebo—a highly statistically significant difference. What makes this particularly intriguing is that 40% of patients on the combination therapy achieved at least 5% weight loss, compared to just 27% with tirzepatide alone.

Perhaps most impressive, Palatin’s data revealed that its drug effectively halted the rapid weight regain typically seen after stopping GLP-1/GIP therapy—addressing one of the most significant challenges facing current obesity treatments.

Massive Market Opportunity: $100B Dollar Obesity Market

The economic potential of anti-obesity drugs is enormous, with the market expected to reach US$100 billion by 2030. As obesity rates continue to climb globally, with the number of obese individuals worldwide projected to increase from 980 million to nearly 2 billion from 2022 to 2035, innovative treatment approaches like Palatin’s could capture significant market share.

With GLP-1 drugs like Wegovy and Zepbound dominating headlines and generating billions in revenue, Palatin’s complementary approach through a different biological pathway offers both standalone potential and synergistic possibilities with existing treatments.

Wall Street Sees Significant Upside Potential

Despite Palatin’s recent clinical successes and positioning in multi-billion dollar markets, the company appears to remain undervalued according to some analysts. According to Tipranks, Wall Street analysts tracking the stock maintain a bullish outlook, with one analyst setting a $7.00 price target for PTN—representing potential upside of over 700% from current levels. This analyst confidence reflects recognition of Palatin’s diverse pipeline, clinical momentum, and unique positioning in the rapidly growing obesity treatment landscape. With multiple catalysts expected in the coming year, including additional data readouts and potential partnership announcements, professional analysts see considerable growth potential that may not yet be fully reflected in the current share price.

Beyond Obesity: A Diverse Pipeline

Palatin isn’t a one-trick pony. The company recently announced positive Phase 2 results for its ulcerative colitis treatment, with an impressive 78% of treated patients achieving clinical response compared to just 33% on placebo. Additionally, the FDA recently granted orphan drug designation to Palatin’s oral MC4R agonist PL7737 for treating obesity caused by leptin receptor deficiency.

The company has also reported positive results in diabetic nephropathy and is advancing treatments for dry eye disease and other conditions—demonstrating a diverse pipeline addressing multiple areas with significant unmet needs.

The Melanocortin Platform: Palatin’s Secret Weapon

What sets Palatin apart is its expertise in the melanocortin receptor system, a biological pathway involved in inflammation, metabolism, and other critical functions. The company has leveraged this platform to develop multiple drug candidates, including Vyleesi®, which received FDA approval in 2019.

Palatin is one of only two companies developing therapies targeting the MC4R pathway for obesity, positioning them uniquely in this growing market.

Potential Outlook

Palatin is advancing next-generation obesity treatments, including long-acting injectable and oral formulations, with investigational new drug applications planned for late 2025 and clinical data expected in early 2026.

As global obesity rates continue to climb and the limitations of current treatments become more apparent, Palatin’s innovative approaches that address both weight loss and weight maintenance could represent significant value for patients and potential appreciation for those who recognize the company’s unique position in this rapidly expanding market.

Recent News Highlights from Palatin (Live)

Subscribe for More Reports

* Legal Disclaimer & Disclosure: Nothing in this report constitutes financial or investment advice, nor does it represent an offer to buy or sell securities. This report is published by Wall Street Wire™ . The operators of Wall Street Wire, arx advisory, are not registered brokers, dealers, or investment advisers. This report contains and is a form of paid promotional content or advertisement for Palatin Technologies and was produced as part of their paid subscription to Wall Street Wire. This report has not been reviewed or approved by Palatin Technologies prior to publication. The operators of wall street wire have received or are expected to receive a one time fee of twenty thousand united states dollars via wire transfer from Palatin Technologies (in two parts) since the start in February 2025 in return for social media distribution and promotional coverage services, and receive additional compensation for non promotional unrelated data and advisory services on top of that. They do not hold any shares in Palatin Technologies. Please review the full disclaimers and compensation disclosures here for further details: redditwire.com/terms. We are not responsible for the price targets mentioned in this article nor do we endorse them, they are quoted based on publicly available news reports believed to be reliable and additional or price targets may exist that may not have been quoted. Readers are advised to refer to the full reports mentioned on various systems and the disclaimers/disclosures they may be subject to. As of the time of this report, the authors hold no shares in any of the companies mentioned.