In a strong vote of confidence for NOA Lithium Brines Inc. (TSXV: NOAL)*, Clean Elements Ltd., led by Chairman Ofer Amir, has increased its position in the company through a market purchase completed on March 13, 2025, according to recent insider filings.

“After witnessing the progress of the project and the market evolution, we wanted to invest the full US$ 10M. We just received approval from the Canadian regulator and from NOA to acquire US$500k at market price. This is a strong commitment from our original investment at 17 cents and now at 35 cents”, Ofer Amir said.

The transaction, disclosed in SEDI filings on March 17, represents continued investment by Clean Elements, which became a strategic investor in NOA Lithium in late 2024. This latest purchase reinforces Clean Elements’ commitment to NOA’s development plans and confidence in the company’s lithium assets.

This move comes at a pivotal time for the lithium sector, with industry forecasts projecting global lithium demand to more than double by 2030. According to a Future Market Insights report published in January 2025, analysts estimate the market will require approximately 52 new lithium mines globally, each capable of producing 30,000 tonnes per annum, primarily driven by accelerating EV adoption and grid-scale energy storage deployments.

Strategic Positioning in the Lithium Triangle

“We continue to see tremendous value in NOA Lithium’s strategic position in Argentina’s Salta Province,” said Ofer Amir, Chairman of Clean Elements, in an exclusive interview. “With the completion of property acquisitions at Rio Grande and a world-class resource of 4.7 million tons of lithium carbonate equivalent, NOA has established itself as one of the most promising development-stage lithium companies in the highly coveted Lithium Triangle.”

NOA’s flagship Rio Grande project features an impressive average lithium concentration of 525 mg/L, placing it among high-concentration projects with substantial economic potential in the region. The company recently completed the acquisition of all properties within its Rio Grande project, significantly de-risking its development pathway.

“This latest investment reflects our long-term commitment to NOA and our confidence in both the company’s assets and management team,” Amir added. “The fundamentals of the lithium market are exceptionally strong, particularly against the backdrop of the rapidly accelerating battery storage market. With battery storage expected to represent 15-25% of total lithium demand, and the tremendous growth projections for the sector, we see a very compelling future for lithium.”

Positioning for Exponential Market Growth

The insider buying demonstrates strategic foresight as lithium consumption is projected to experience a fast rate of aproximatly 15-25% between 2025-2035, with market value expected to reach USD 16 billion in 2025 based on the estimated demand of 1.5 million metric tonnes and the current prices of lithium. Experts anticipate the market will shift from current conditions to a significant supply deficit by the end of the decade, driving renewed interest in high-quality development assets.

Rising Global Demand Amid Supply Constraints

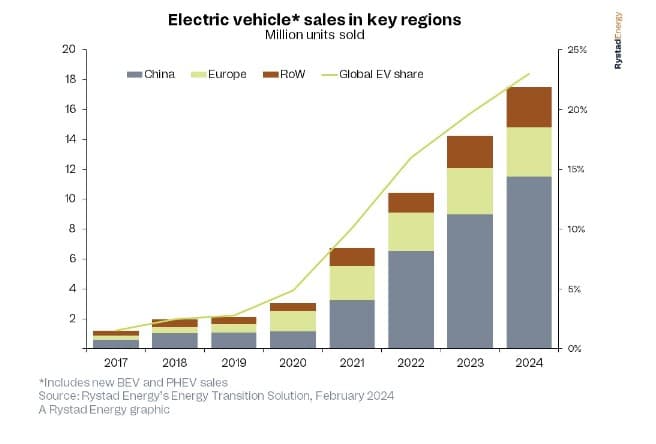

NOA’s development progress coincides with accelerating global demand for lithium, primarily driven by electric vehicle production and ESS (Energy Storage Systems). According to S&P Global data, global plug-in electric vehicle sales reached 16.5 million units in 2024, a 28.5% increase from the previous year.

The EV market seems to be approaching a critical tipping point, with new models achieving price parity with internal combustion engine vehicles while offering approximately 80% lower operating and maintenance costs. Recent technological breakthroughs are also addressing charging speed concerns, with China’s BYD unveiling a revolutionary new Super e-Platform on March 17, 2025.

The platform’s flash-charge batteries support an unprecedented 10 C charging multiplier—the highest of any mass-produced power battery in the world—enabling a theoretical full charge in just six minutes. According to BYD, the system features charging voltages of up to 1,000 V and currents of up to 1,000 A, enabling charging power of 1,000 kW (1 megawatt), twice the peak power of Tesla’s latest V4 supercharger.

China continues to lead this growth, accounting for 86% of the global increase in EV sales in 2024 according to S&P Global Commodity Insights data released in February 2025. The country recently doubled nationwide EV subsidies, and has nearly tripled its lithium reserves, making it the second-largest holder worldwide behind Australia.

Meanwhile, the development timeline for new lithium mines remains challenging, typically taking around 16 years from discovery to production. This supply constraint, coupled with surging demand, creates a favorable long-term outlook for established projects in mining-friendly jurisdictions like NOA’s portfolio in Argentina.

Competitive Landscape

NOA’s continued advancement places it in a strong position among lithium developers, particularly following Rio Tinto’s $6.7 billion acquisition of Arcadium Lithium in October 2024, which validated the premium valuations for quality lithium assets in the region.

The lithium market is entering a phase of extraordinary growth. With the International Renewable Energy Agency (IRENA) estimating a tenfold increase in lithium demand for batteries alone between 2020 and 2030, major automotive manufacturers and battery producers are aggressively securing sustainable, long-term supply.

With a strengthened financial position following the Clean Elements investment, NOA continues to advance exploration and development activities across its 140,000-hectare portfolio, which includes the Rio Grande, Arizaro, and Salinas Grandes projects. The company plans to begin water exploration drilling at Rio Grande before the end of the first quarter of 2025, with engineering proposals for the project’s preliminary economic assessment currently under evaluation. This progress positions NOA to potentially become a significant contributor to global lithium supply as the market faces projected shortfalls later this decade.

Recent News

- The $4.1 Trillion Healthcare Revolution: How DarioHealth Could Rewrite the Rules of Chronic Disease Management

- Global Trade Tensions Rise: China’s Market Dominance Sparks G7 Concerns and Brazil’s Automotive Crisis

- Enhanced Security Measures for U.S. Student Visas: New Social Media Screening and Stricter Vetting Protocols

- Russian Hawks Press for War as Conflict with Ukraine Deepens and Tensions Rise Within the Kremlin

- Bureaucratic Resistance: The Struggle for Presidential Control in a “No Kings” Era

Subscribe for More Articles Like This

*Disclaimer: Nothing in this report constitutes financial or investment advice, nor does it represent an offer to buy or sell securities. This report is published by Wall Street Wire™. The operators of Wall Street Wire are not registered brokers, dealers, or investment advisers. This report contains paid promotional content related to Noa Lithium Brines Oil and was produced as part of their paid subscription to Wall Street Wire. This report was not reviewed by Noa prior to publication. Please review the full disclaimers and compensation disclosures here: redditwire.com/terms. Readers are advised to refer to the full news releases mentioned and or linked and the issuers full financial and regulatory filings.